Fraud in e-commerce is probably the biggest fear of all business owners, statistics show that about 36 percent of companies take it into account. According to a study by NACS, for every dollar written off by fraud, retailers lose $3.60.

The trade industry has seen great changes and difficulties over the past decades, facing pandemics, scams, and rapidly changing trends. At the same time, it was important to remain always available to the customers and provide them with a comfortable environment and a positive shopping experience.

In this case, fraud would create a negative trend and the threat of losing potential buyers. So your duty is to prevent and protect your customer from this. According to a survey by the National Retail Federation (NRF) performed in 2019 businesses lose nearly $61.7 billion because of crime alone.

The pandemic period of COVID-19 increased the demand for fraud in e-commerce or retail. Convenience and Fuel Retail Association (NACS) conducted research in which they found that during the pandemic the volume of fraud in the US increased by 15%.

Retail crime and fraudulent transactions continue to have a negative impact on the finances of retail stores. The 2019 National Retail Federation (NRF) Annual Retail Security Study found $61.7 billion in lost revenue due to crime alone.

Types of Fraud Detection and How Does It Work In E-Commerce?

However, thefts are becoming more and more sophisticated and complex over time, so it is possible to single out those that are most common.

Transaction Fraud

This is usually caused by the absence of a card (CNP), which is used for online purchases. thus the company loses money when the original cardholder demands a refund.

Refund Fraud

The development and spread of e-commerce have led to the acceleration of the return or exchange procedure. This has become a desirable trick for fraudsters. They use various price manipulations, checks, open boxes, and price arbitrage. Sellers suffered numerous losses and lost profits or customers.

False Activation

In order to prevent fraud in retail trade, a special mechanism was created, which should block all transactions, and fraud or even control the payment of the commission from the staff’s pocket. At the same time, the program could work better and blocks even legitimate clients. This is called false certification, which damages your reputation.

“Friendly Fraud”

Sometimes fraud occurs even from innocent or random inquiries that cannot spoil a purchase made with their own credit card, customers demanding a refund for literally everything, or chargeback fraud. The client receives the product while saying that it did not arrive and demands a refund.

Warranty Fraud

In recent years, e-commerce fraud has been increasingly developing under the guise of refunds. Therefore, companies often use software that blocks this type of transaction, but sometimes it fails and is applied to real buyers.

Triangulation Fraud

This kind of manipulation of the client appeared relatively recently, but many e-traders have already encountered it. Everything works in this way regarding the relay store and the real customer and the fake online store. it is accordingly controlled by a person who is interested in illegal profit and has access to stolen credit cards.

Methods For Fraud Protection

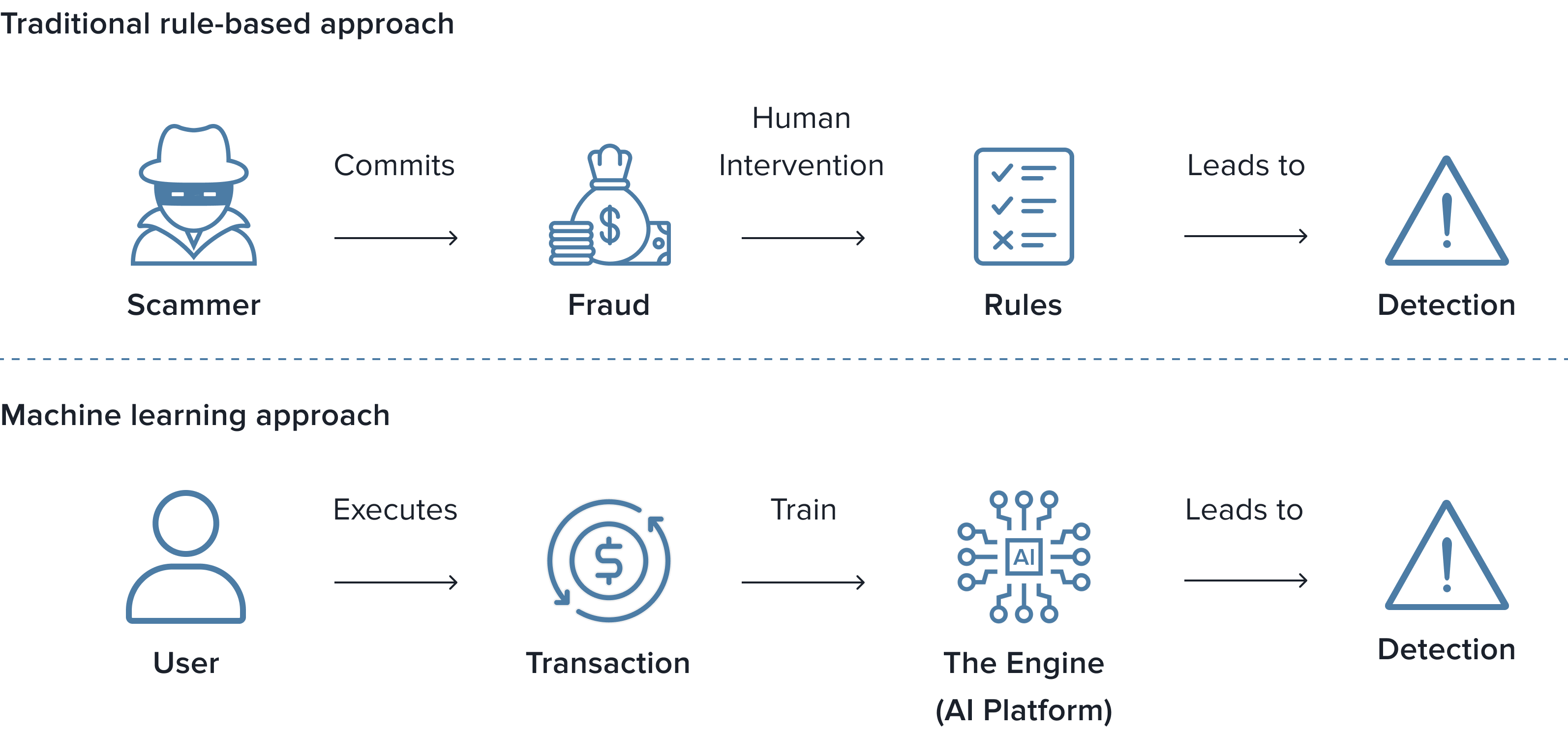

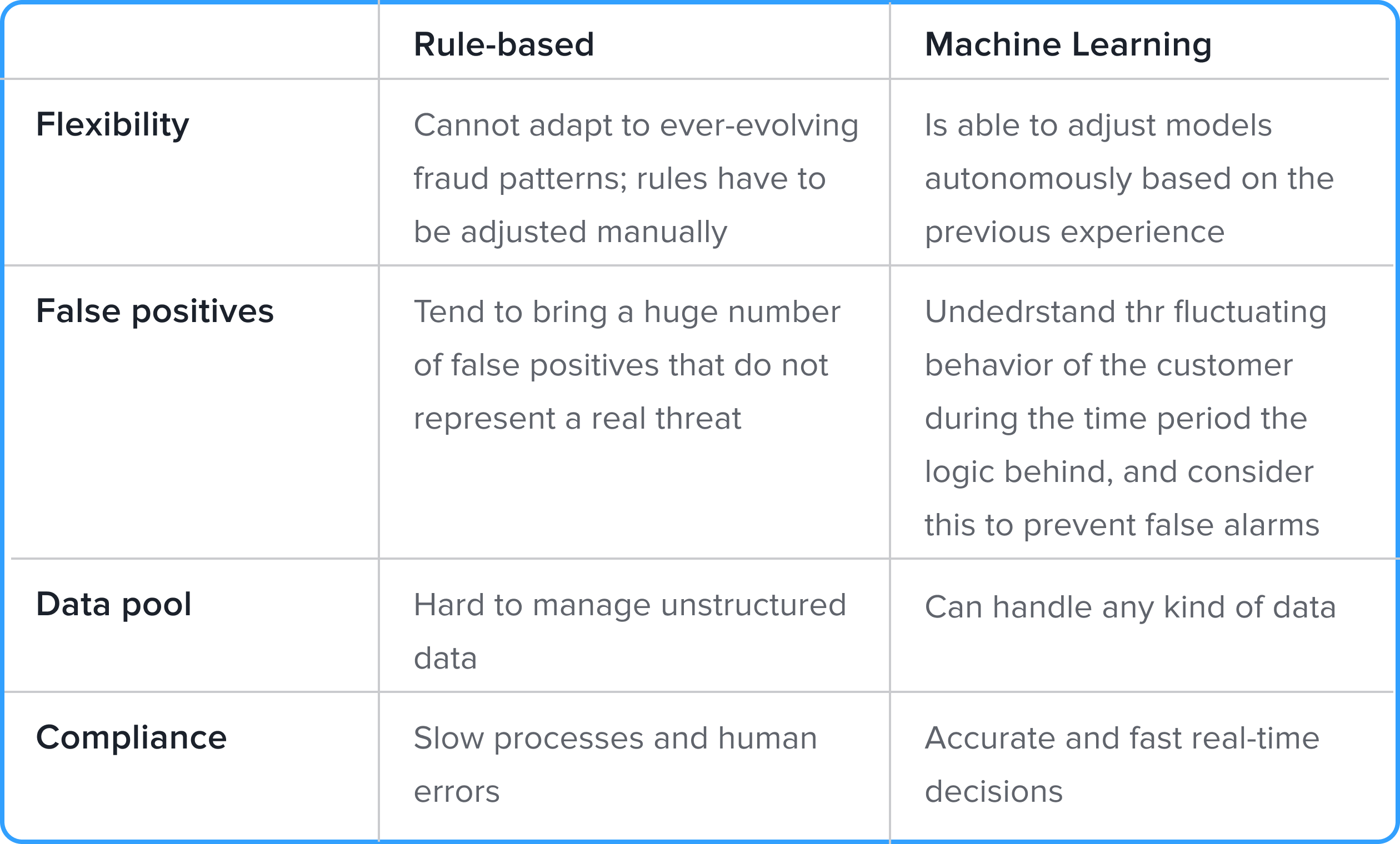

There are many ways to detect and prevent fraud. You can do everything manually, with the help of support services or payment methods, or you can use systems based on rules. They use if-then logic. In this way, plans have a clear scenario and situational task and predict behavior that seems suspicious to them. However, this kind of method has a big drawback, which is that the system cannot control the flow of data in real-time. In addition, employees would have to independently review all transactions for possible fraud. This precedes the irrational expenditure of both money and time. Add to this false blockings by the system of real customers, new possible frauds of a more sophisticated nature, and the time delay due to the human factor, and you get a not entirely effective model to implement in your business.

Machine Learning based model

In contrast to all previous methods, you can use a model based on Machine Learning algorithms that will work with historical data and automatically understand recurring patterns when recognizing fraud. Unlike traditional solutions based on simple if-then logic and manual entry of rules, models based on machine learning work almost automatically. In addition, they can record suspicious cases or anomalies that deviate from the norms and, thus, can predict potential crimes. Another advantage of machine learning is that its data models, i.e. mathematical representations of previously identified recurring patterns and anomalies, can be refined based on experience. Models quickly adapt to new threats and are updated with fresh information.

Мachine learning models are particularly effective in distinguishing an actual crime from a real event. It will consider the use of credit cards according to their purpose and the regularity of payments to protect customers from potential bad experiences.

Machine Learning Models and Algorithms For Fraud Detection

To understand how you can protect your business from fraud, you need to understand how machine learning models work and how to work with them.

As with everything, in this case, you need to go through several steps:

- Step 1. Data entry. Data collection and segmentation form the basis of any work with models. More data – a more reliable algorithm – more predictions and situational problems.

- Step 2. Extract function. In this case, you highlight the components that will become signals of fraud and negative customer behavior. They are broken down into specific categories, including customer payment methods, order details, location, alternative networks, or identification data.

- Step 3. Machine learning algorithms. Machine learning follows certain rules that will serve as pointers to distinguish between legitimate activity and fraud.

- Step 4. Work with models. When you have finished training your model, you can work with it, constantly updating and improving it.

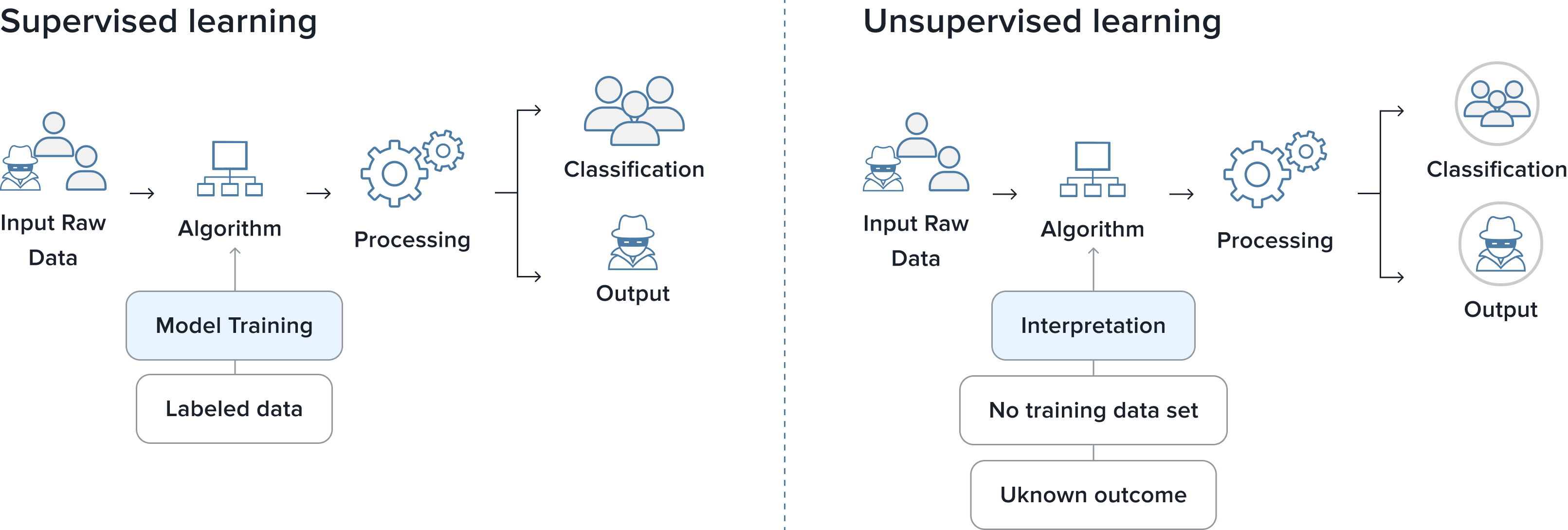

Supervised Learning

Such a system works on the basis of Machine Learning using large-scale data pre-labeled with a description of its main features. This can be, for example, data marked as “fraudulent” or “non-fraudulent”. Such labeling is introduced as input data (transactions) and according to the pre-codes that have been classified, they are labeled to create patterns and predict future cases.

Unsupervised Learning

This model learns without human intervention. Transaction data powers algorithms without using tags. This allows them to group themselves and form sections based on their similarities – common patterns of behavior and differences – atypical situations that can tell about fraud. This approach requires numerous calculations, so it also uses Deep Learning algorithms.

Logistic regression

The model developed by this method analyzes structured data sets and evaluates causal relationships in them and calculates the probability of the target variable. The result is calculated based on a set of parameters: fraud check (location, frequency, identification) and categorical decision (fraud or not fraud). The model calculates the result with a probability of 0 or 1.

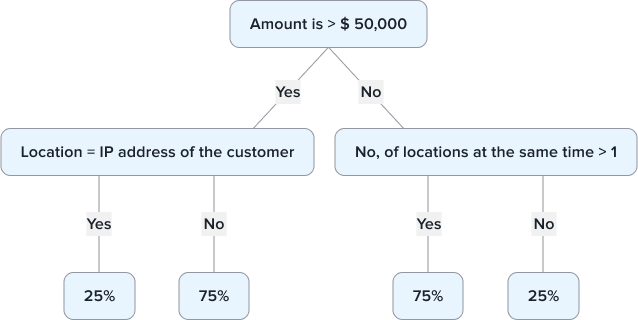

Decision-tree-based Method

The method based on the decision tree is more adapted to the classification of unusual actions and more progressive results. The decision tree is built on the basis of a branch-like scheme, where each subsequent decision comes from the previous one. Such a structure forms a decision-making node. It is logically built from rules, according to which we can accept some conclusions and results – leaf nodes. Such leaf nodes have no further division and are divided into subtrees based on yes/no answers.

Random Forest

Another type of machine learning model works on the basis of concepts of ensemble learning. To improve accuracy and improve results, the method combines multiple decision trees. Thanks to this, it stands out for its high accuracy, while it does not necessarily have to have huge data sets. Another advantage is that the model learns quickly.

Neural Networks

Neural network-based models function in much the same way as the human brain and are multi-layered. For companies that use a huge amount of data, artificial neural networks, which are also known as deep learning models, are suitable. From this, we can conclude that they can solve complex tasks and operate with a large amount of data. Multilevel gives them the opportunity to train on many functions, expand and possess various parameters.

Real Cases of Machine Learning in Fraud Detection

The use of Machine Learning can save a business from considerable problems related to fraud. At the same time, it will do it quickly and save you money. Let’s find out in which cases the use of machine learning models will help you protect yourself from unwanted situations and customers.

Theft of Personal

Data In this scenario, the fraudster steals the user’s page data, changes his credentials to his own, and tries to get the seller’s product or funds using false information. Models based on machine learning algorithms analyze user behavior. They detect actions that do not resemble the actions of the real owner and find inconsistencies in historical sets of personal data.

Commercial Fraud

Companies or traders operating through markets are most susceptible to this type. Customer reviews play an important role here. That is why it becomes fodder for fraudsters who use fake reviews in order to attract more customers. Machine learning algorithms, with the help of sentimental or behavioral analytics, can detect suspicious actions that indicate a seller is doing dishonest business.

Verification of Transactions

Many e-commerce stores try to verify transactions to prevent fraud. However, these checks take a lot of time and do not protect you from inaccuracies. Buyers whose orders you rejected due to suspected dishonest policies will never return to you.

Machine learning, using significantly less of your resources, will be able to tell you with greater accuracy whether a transaction is legitimate or not. This will reduce false deviations and simplify your work with the client.

Dummies

Machine learning and Artificial Intelligence have brought many new tools and methods to the process of verifying a person’s personal data. Now it is much easier to check ID parameters or recognize if a person owns a credit card. The model analyzes paper verification, ink, biometrics, and crowd recognition. Therefore, it became easy to do complex profiling of the client and protect yourself from fraud.

Abuse of Promo Codes And Loyalty Programs

Many e-merchants, in order to be loyal to their customers, become their own victims. This is where Machine Learning comes in handy, as it detects customers using multiple accounts or servers to make illegal purchases or extort money.

Refunds

Machine learning models make your refund much safer. The AI solution lies in detecting anomalies and assessing risks. They analyze risk identifiers and examine your customer interactions based on your policies. This will make refunds less risky.

Fraud in M-commerce

Mobile e-commerce is now quite common, and therefore it also falls prey to fraudsters. To prevent this phenomenon, machine learning algorithms evaluate the risks of transactions in real-time. This helps them immediately detect and prevent illegal profit. Machine learning-based models analyze behavior and send alerts when something abnormal is detected.

Benefits of Using Machine Learning Fraud Detection in E-Commerce

Now, have understood how Machine Learning works in predicting fraud, it is worth summarizing what benefits you will get if you implement its algorithms in your business.

Faster Response and Mobility

Machine learning algorithms respond quickly to any changes in fraud patterns, unlike a rule-based approach. Because the models are constantly learning and improving, they easily process large amounts of new data, adapting to threats and warning their users.

An example of the advantage of such a solution is the Capgemini company, which uses CPP Fraud Analytics software, which is based on Machine Learning. They used Models to prevent credit card fraud and thus increased their profit from it by 40% and reduced the time to detect fraudulent behavior.

Reduction of False Detections

False positives is actually quite a common problem for systems that separate customer behavior into black or white. They require re-verification, which takes a lot of time and resources. Machine learning-based solutions are much more economical and effective because they take into account more variables and the overall context. This allows you to see the case from afar and prevent false alarms.

Such a system was introduced by Danske Bank, which wanted to create a system that would fight against money laundering. A solution based on machine learning helped to reduce the number of false positives by 60% and to increase true ones by 50%.

Broader Data Usage and Scalability

Processing unstructured data causes difficulties in rule-based systems. Such data can include written reports, human documents, or insurance claims. In contrast, Machine Learning, with the help of NLP or Computer Vision, can work with any data, improving the pool of valuable information. Machine learning models are highly scalable because they are constantly improving and learning.

Insurance company Chola MS uses machine learning algorithms to collect data from customer surveys. Machine learning systems automatically compare this data with photos and emails from real people to identify discrepancies and save time.

Faster and More Accurate.

In an industry like e-commerce, it is very difficult to react quickly to any changes or abnormal behavior. This is what creates a huge drawback for a method based on rules and constant human intervention. A solution developed on the basis of machine learning also wins here. It provides your business with accuracy and speed, minimizes the impact of the human factor, and protects it from losses.

The Nasdaq company works with a solution developed on the basis of Machine Learning. The model detects fraudulent stock orders and reports them to the relevant authorities, as well as investigates unfamiliar trading patterns. This provides businesses with a transparent market and protection against unknown types of fraud.

After All

Just as the world of e-commerce evolves, so do the types of fraud. Therefore, it is important to always remain cautious and be able to respond in time to any challenges that arise before us. Implementing machine learning algorithms into your security system can keep you and your users safe. This will not only affect the internal work with the client but also save him from a non-responsive experience. Don’t wait to be fooled – implement solutions based on machine learning. Get satisfied customers, clean business, and increased profits.